Have you ever tried to apply for a loan, buy something on installment, or get approved for a credit card and been told, “You don’t have a credit score”?

You’re not alone.

Many Nigerians are just beginning to understand the credit system. If you’ve checked your credit report using the PebbleScore app and saw that no score is showing, don’t panic. It doesn’t mean something is wrong. But it does mean you have work to do to become credit-visible.

Let’s explore the common reasons why you might not have a credit score in Nigeria, and how you can fix it.

1. You’ve Never Used Any Type of Credit Before

In Nigeria, many people are completely unbanked or only use cash and transfers. If you’ve never taken a loan, used a credit card, or signed up for a service that reports your payments, there’s no data for credit bureaus to track.

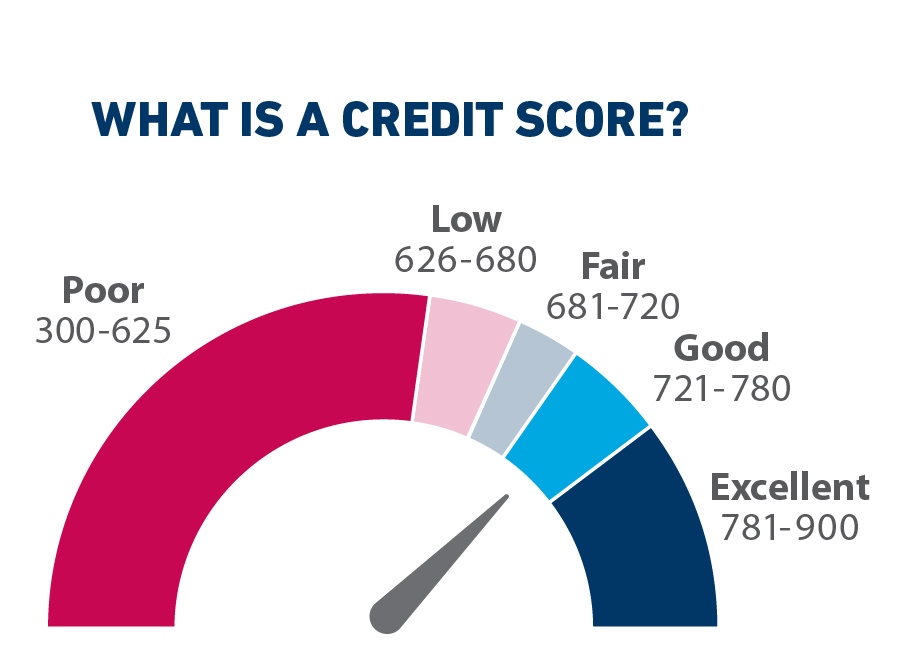

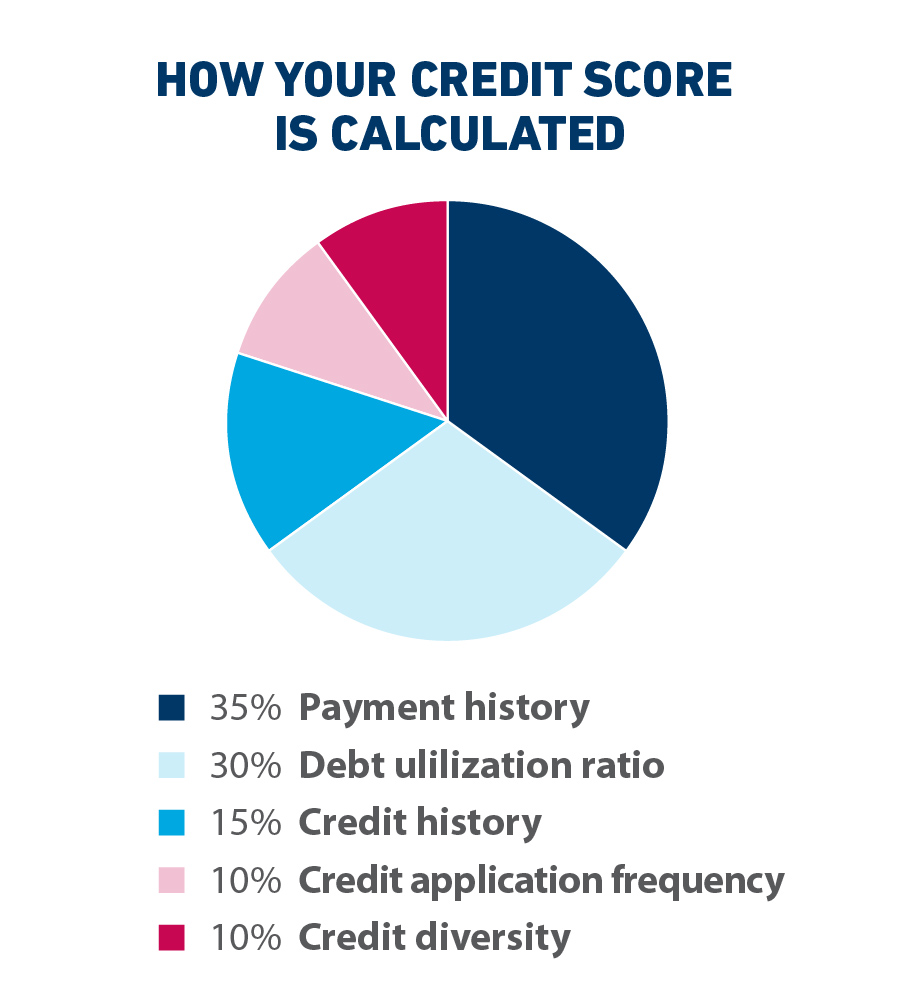

Because your credit score is calculated from your financial history, no activity means no score.To start building one, explore credit builder tools like the PebbleScore Credit Booster, which allows your airtime and bill payments to count toward your credit history. Learn more here

2. Your Last Credit Account Was Too Long Ago

Credit reports in Nigeria typically track activity for about six years. If you used credit a long time ago, maybe when you took a loan from a microfinance bank or a mobile lender and haven’t used credit since, your activity may have dropped off your report.

This is why maintaining active, healthy financial behavior is key to keeping your score alive.

You can learn how to read and understand your credit report to see what’s still showing.

3. You Recently Got a BVN or Opened Your First Bank Account

Your Bank Verification Number (BVN) is one of the key identifiers used by credit bureaus in Nigeria. If you’ve just gotten one recently, it may take some time for credit activity to accumulate.

Additionally, opening a new account is a great first step, but it doesn’t automatically give you a score.

To speed things up, begin using financial tools that report to credit bureaus, like utilities, airtime top-ups, or digital loans but always repay on time.

4. You’re Young or Just Entering the Financial System

If you’re under 25 or just starting to earn regularly, you likely haven’t had enough time or activity to generate a credit score yet. That’s okay. It just means you’re at the start of your financial journey.

Starting early gives you time to build strong credit habits. This blog on credit building tips for Nigerians can show you how to get started.

5. Your Credit Was Recently Cleared or Disputed

In some cases, users who’ve recently used PebbleScore to dispute errors or resolve past issues may see a “no score” status while their records are being updated.

This temporary dip can feel frustrating, but it’s actually part of the repair and rebuilding process.

Read this guide on credit repair for beginners to understand how long it might take and how to bounce back.

What You Can Do Today

If you don’t have a credit score, the most important thing is not to stay invisible. Here are some action steps to help you:

- Download the PebbleScore app to access your credit report from all three Nigerian credit bureaus.

- Use the Credit Booster to build history from your everyday payments.

- Dispute any errors that may be holding you back.

- Learn how credit works, and keep reading our financial guides.

Your score may be missing today but with the right steps, you’ll start seeing it grow.